Income Tax Rate 2025 Individual. An individual has to choose between new and. Check out the latest income tax slab for salaried, individuals and senior citizens by the it department.

In the new income tax. This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories of persons viz.

Key announcements, income tax slab rate and more updates by fm nirmala sitharaman toi business desk /.

Check here for the latest income tax slabs & details of different income tax regimes for tax slabs in india.

Tax rates for the 2025 year of assessment Just One Lap, Key announcements, income tax slab rate and more updates by fm nirmala sitharaman toi business desk /. Use the income tax estimator to work out your tax refund or debt estimate.

Individual Tax Rates 2025/2025 Lanna Pietra, Check out the latest income tax slab for salaried, individuals and senior citizens by the it department. The content on this page is only to give an overview and general guidance and is not.

Tax Rate 2025 Individual Abbe Mariam, Income tax slabs revised, standard deduction raised from rs 50,000 to rs 75,000 under the new tax regime in budget 2025. In the new income tax.

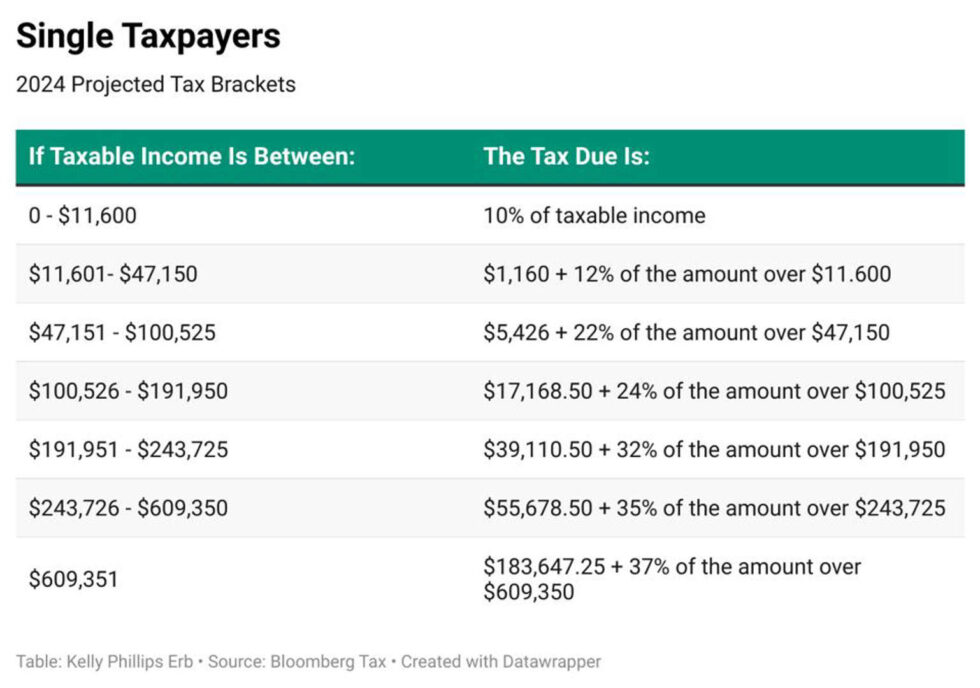

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, The government has increased the standard deduction limit to rs 75,000, allowing the salaried class to save up to rs. Discover the tax rates for both the new tax regime and.

Individual Tax Rates 202425 Merna Stevena, Harris wanted to raise the corporate tax rate from 21 percent to 35 percent, which is higher than the 28 percent that mr. Income tax slabs revised, standard deduction raised from rs 50,000 to rs 75,000 under the new tax regime in budget 2025.

Individual Tax Rates 2025 Ato Calla Corenda, The content on this page is only to give an overview and general guidance and is not. Income tax slabs revised, standard deduction raised from rs 50,000 to rs 75,000 under the new tax regime in budget 2025.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Harris wanted to raise the corporate tax rate from 21 percent to 35 percent, which is higher than the 28 percent that mr. This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories of persons viz.

Tax Brackets 2025 Federal Ros Sarette, Income tax slabs revised, standard deduction raised from rs 50,000 to rs 75,000 under the new tax regime in budget 2025. The content on this page is only to give an overview and general guidance and is not.

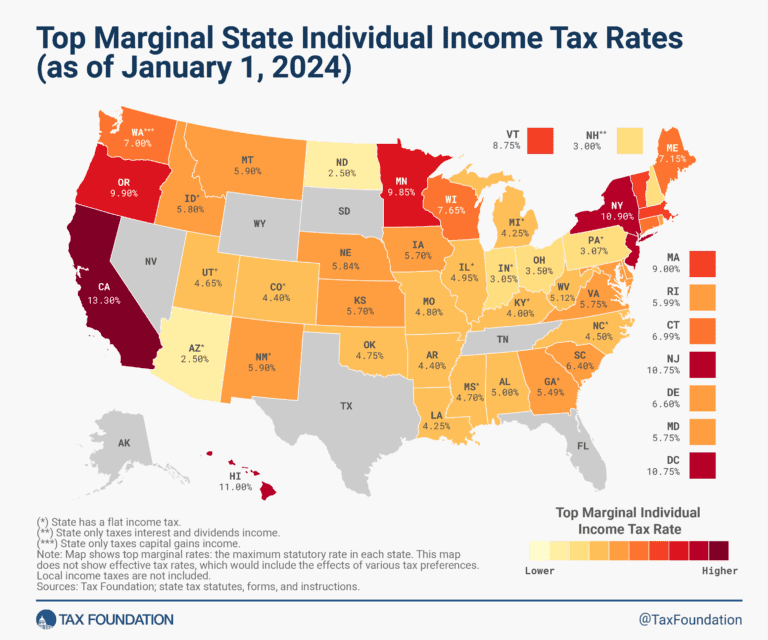

State Individual Tax Rates and Brackets, 2025 Taxes Alert, The following tables show the revised income tax slabs, not the old tax regime. Chargeable income in excess of $500,000 up to $1.

Tax Rates 2025 25 Image to u, The income tax rates for individuals, senior citizens, super senior citizens, hufs, and other entities are provided in a tabular format for easy reference. Check out the latest income tax slab for salaried, individuals and senior citizens by the it department.

Check here for the latest income tax slabs & details of different income tax regimes for tax slabs in india.

Income Tax Rate 2025 Individual. An individual has to choose between new and. Check out the latest income tax slab for salaried, individuals and senior citizens by the it department. In the new income tax. This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories of…