Irs Forms 2025 Estimated Tax Payments. This includes earnings from freelance work or self. You'd expect to owe at least $1,000 in taxes for the current year (after subtracting refundable.

It’s important to calculate your estimated tax payments accurately to avoid underpayment penalties and interest charges from the irs. By proactively managing your estimated tax payments, you can achieve peace of mind and even a healthier cash flow by eliminating large lump sum payments on tax day and.

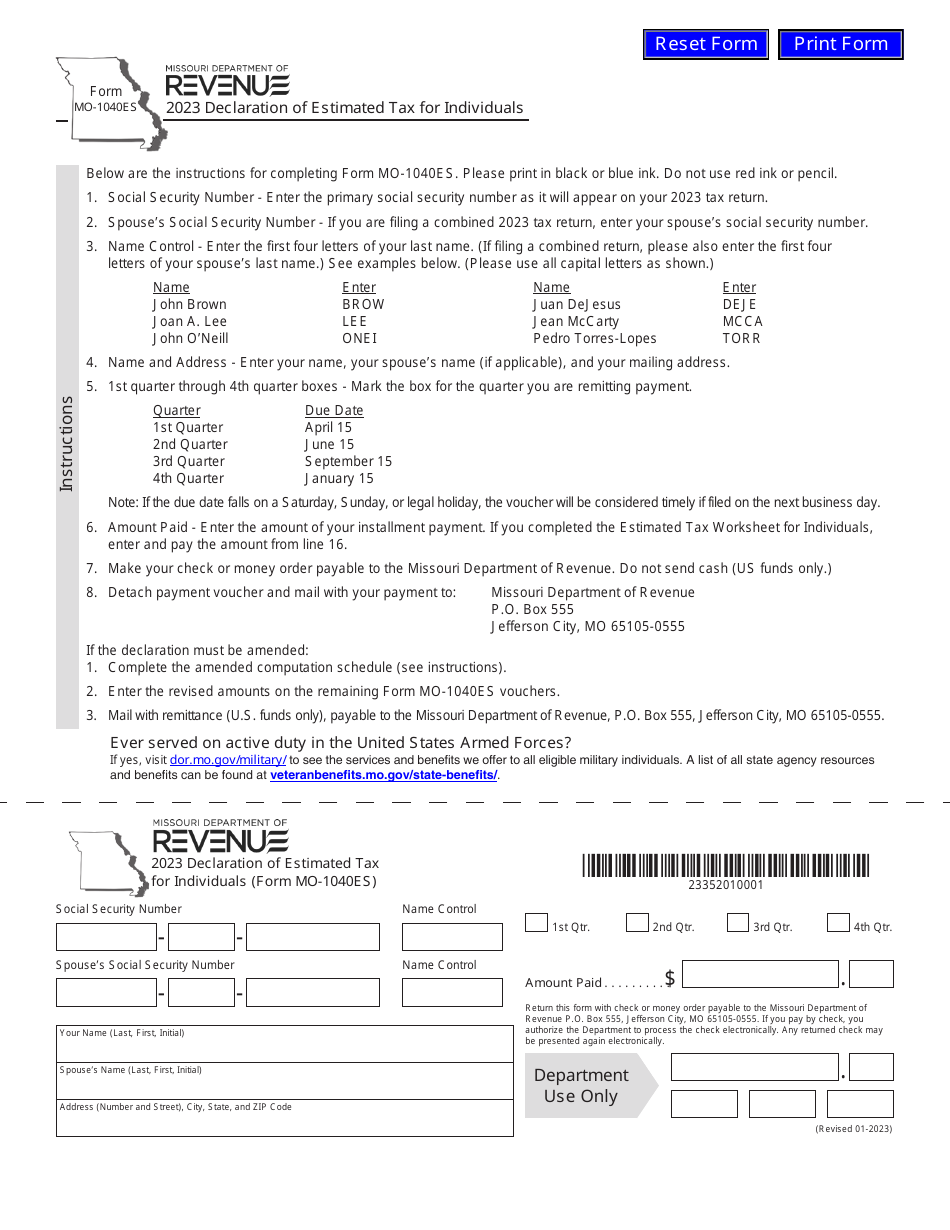

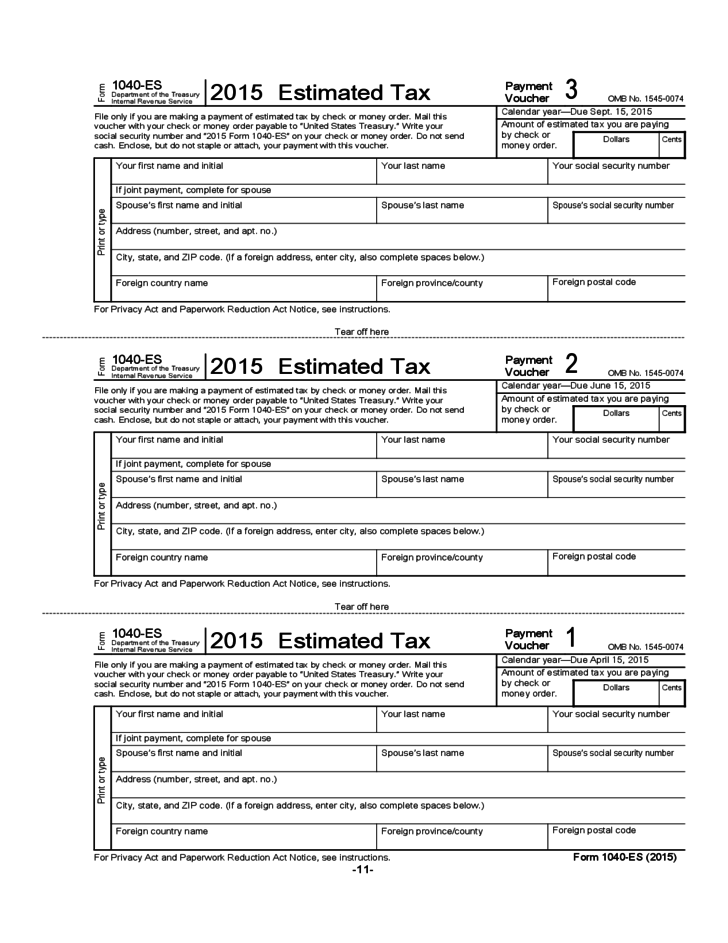

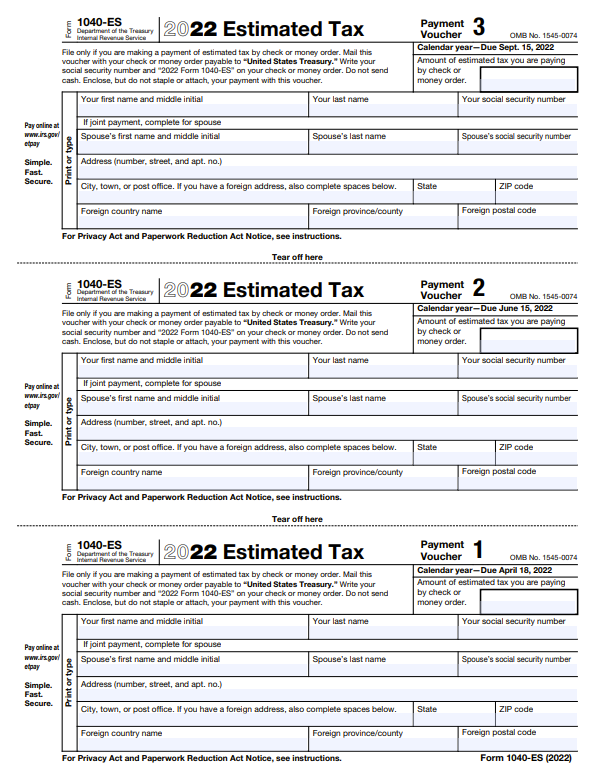

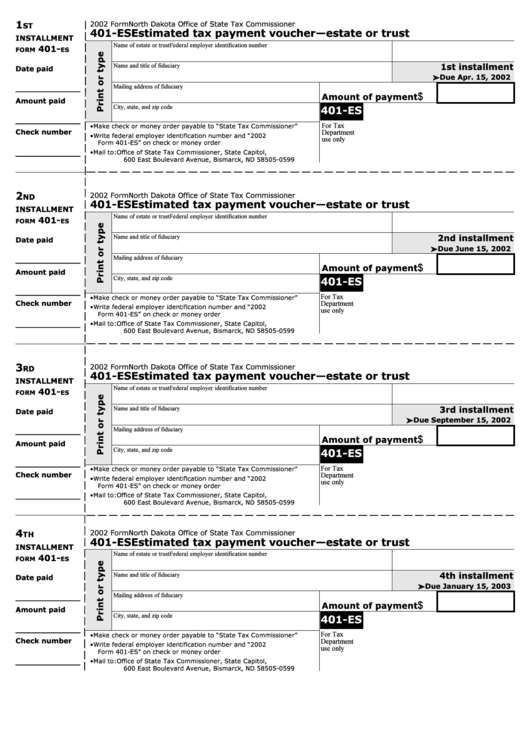

Irs Estimated Tax Forms 2025 Printable Eula Tammie, There are two methods for calculating estimated tax payments:

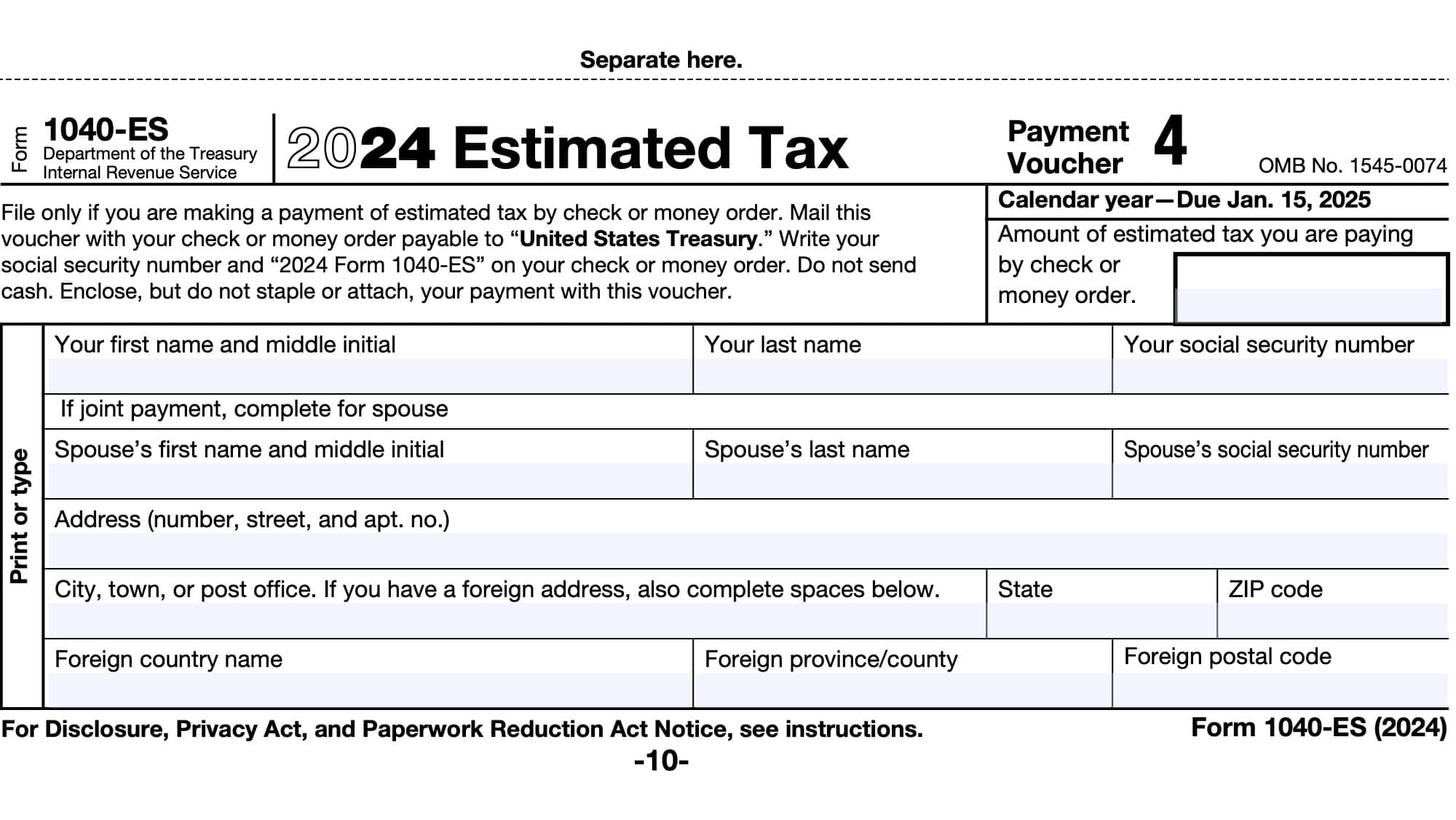

Estimated Tax Payments 2025 Irs Online Yoko Shannon, How to make estimated tax payments and due dates in 2025.

2024Es 2025 Estimated Tax Payment Vouchers Luci Mikaela, Learn what they are, due dates, who should pay, how to calculate and make payments.

Irs 2025 Estimated Tax Payment Forms Blinni Linnea, It’s important to calculate your estimated tax payments accurately to avoid underpayment penalties and interest charges from the irs.

Irs 2025 Quarterly Estimated Tax Forms Torey Halimeda, Also, paying your taxes throughout the.

IRS Form 1040ES Instructions Estimated Tax Payments, You'd expect to owe at least $1,000 in taxes for the current year (after subtracting refundable.

Virginia State Estimated Tax Payments 2025, There are two methods for calculating estimated tax payments:

Irs Estimated Tax Payments 2025 Forms Hedda Krissie, This includes earnings from freelance work or self.

Irs Estimated Tax Payments 2025 Forms Hedda Krissie, Estimated taxes are “pay as you go,” according to the irs, and are spread across four payments.

Irs Estimated Tax Payments 2025 Forms Hedda Krissie, Discover everything about irs estimated tax payments for 2025.